„People need to understand finance. At the present moment I think that maybe 1% of the population really understands how the financial system really works.“

Yuval Noah Harari, BIS Innovation Summit, May 2024

Foreword

At the beginning, there was the need. It is the primal instinct that has existed since the dawn of humanity – the desire to secure our survival, enhance our well-being, and find our satisfaction. These fundamental needs for food, shelter, and social connection were the driving force behind our quest for solutions. We started to grow food together, protect ourselves, and establish social networks.

As we began to produce goods and services, we specialized in what we did best. This specialization allowed us to perfect our skills and produce more of what we excelled at. If someone was particularly good at making clothes and another excelled at growing food, trade was the logical consequence. Through exchange, we were able to make the best use of our resources and at the same time expand our variety of products and services.

In the earliest societies, trade began at the local level, where communities exchanged their surpluses to meet their individual needs. Trade not only brought a greater variety of products and services but also economic efficiency. In short, trade is a natural response to our needs and an essential part of human interaction and collaboration. In the past, trade was primarily based on bartering. However, this presented its own challenges.

Then came money. Money made trade simpler and more efficient by representing a fixed value and eliminating the need for direct bartering. It also allowed us to save and plan for the future. The history of money spans from the Neolithic Revolution about 10,000 years ago to the present, with the monetary system continually evolving and adapting to technological advancements.

Initially, shells, grain or livestock were used as a means of payment. Later, coins and paper money appeared. Over time, the banking system and modern currencies as we know them today emerged. With the advent of computers, the internet, smartphones and wireless communication in the 21st century, the digitalization of finance began. This led to the emergence of various electronic payment methods such as credit cards, online bank transfers and cryptocurrencies. Since 2021, there has been increasing discussion about the introduction of CBDC (Central Bank Digital Currency) for the general public.

This article provides an understandable overview of the evolution of monetary systems and key technological developments that will serve as the basis for the future financial system. It sheds light on backgrounds and interesting connections that drive the global efforts to introduce CBDCs as the next milestone in the history of money. We will also take a look at the potential impacts that the introduction of CBDCs could have on our economic, political, social, and cultural life.

1. Monetary systems and their development

1.1. What is money?

1.2. Commodity money

1.3. Representative money

1.4. Fiat money

2. The Fiat system – Alice in Wonderland

2.1. Primary money creation

2.2. Secondary money creation

2.2.1. Secondary money creation via customer deposits

2.2.2. Secondary money creation through lending

2.3. The influence of central bank policy on the money supply

2.4. The risks of loose monetary policy and its effects

2.5. The digitalization trend

3. Cryptocurrencies – All roads lead to Rome

3.1. Distributed Ledger Technology (DLT)

3.2. Blockchain-Technology

3.3. The Token – The Swiss Army Knife

3.4. Centralized vs. Decentralized Ledger System

3.5. Bitcoin (BTC) – Get Rich or Die Tryin’

3.6. Tether (USDT) – Safe Haven (In God We Trust)

3.7. Libra – The King is Dead, Long Live the King!

3.8. Ethereum – Code is Law

3.8.1. Chainlink – Oracles, mediators between the gods and humans

3.8.2. Behind the scenes – Shadows on the wall

3.9. Interim balance

4. CBDC – The Digital EURO – A New Star is Born

4.1. Wholesale CBDC – Nature does not make leaps (or does it)

4.2. Commercial Bank Money Token (CBMT) – Those who do not go with the times, perish with time.

4.3. Retail-CBDC – Heaven Is a Place on Earth

5. A glance into the future – Welcome to the tokenisation continuum

6. Epilogue

1. Monetary systems and their development

1.1. What is money?

Money is essentially a tool that facilitates our ability to obtain things we want or need without having to directly exchange them for other items. Imagine you have an apple that you want to trade for a banana, but your friend doesn’t have a banana; instead, he has something else you don’t necessarily need. This is where money comes into play. You can exchange your apple for money. Then, you can use this money to buy a banana from someone else who has bananas. So, money acts as a „middleman” of sorts in the exchange of goods. It allows us to buy and sell goods and services easily without having to worry about the direct exchange of goods.

The above example works because money serves as a generally accepted medium of exchange. It has an agreed-upon value that people accept and it facilitates the exchange of goods and services, even if they cannot be exchanged directly.

In this example, everyone involved has confidence in the acceptance of money as a means of payment. If you exchange your apple for money, you assume that you can later use this money to buy something else that you want, such as a banana.

Money represents value. However, for money to have value, people must trust that it indeed has value and will continue to hold value in the future, which they can utilize -> Money = Value = Trust.

Every monetary system that has developed throughout history has been a response to the needs and challenges of its time. Let us now take a brief look at how monetary systems have evolved over time.

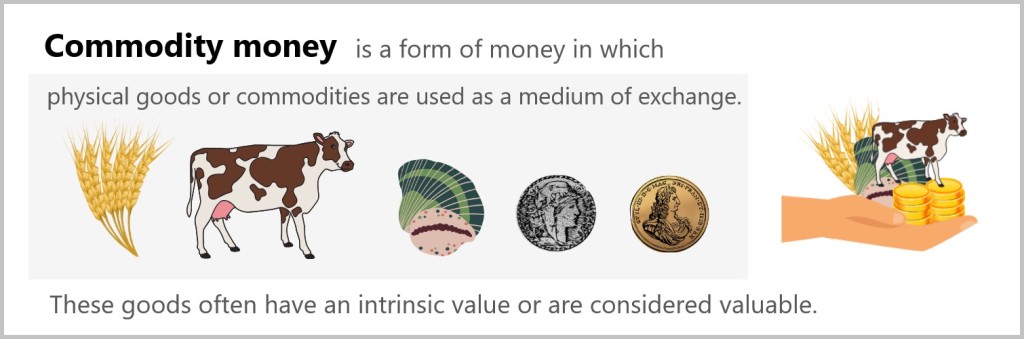

1.2. Commodity money

As already mentioned, monetary systems arose out of the need to facilitate trade and the exchange of goods and services. Compared to moneyless barter, the use of a certain commodity that could be easily exchanged proved to be more efficient. Examples of such means of exchange were shells, livestock, grain, cocoa beans or precious metals such as gold and silver. These objects had an intrinsic value (actual, fundamental value) or were considered valuable, which made them an acceptable medium of exchange. This oldest form of money is called commodity money.

Precious metals turned out to be particularly suitable for use as commodity money, mainly due to their high durability. However, these metals had to be laboriously weighed and divided as required. Therefore, the next logical development step was the production of coins or bars that had a fixed precious metal content and a specific nominal value.

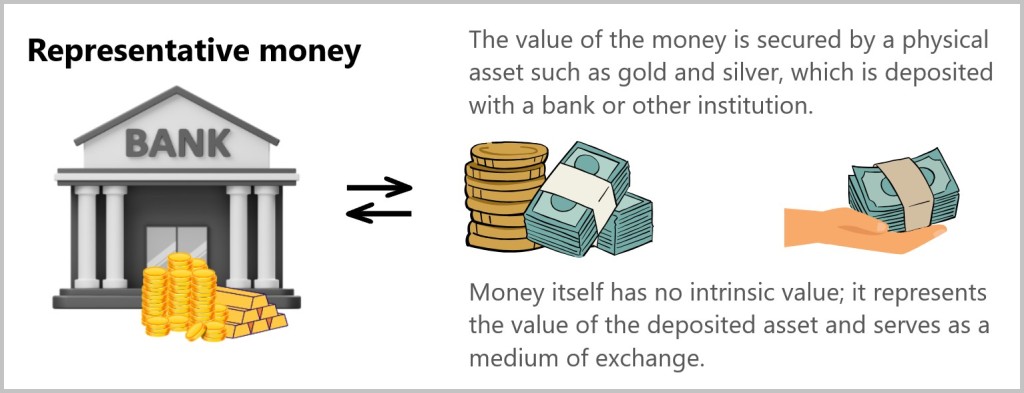

1.3. Representative money

Over the course of history, people found it cumbersome to transport gold bars or other forms of commodity money over long distances. For this reason, paper money eventually emerged from these mediums of exchange, serving as the basis for representative money. Representative money is backed by a physical object or commodity. A simple example of representative money is a gold certificate.

Suppose you own a gold certificate that states it entitles you to a certain amount of gold, for example, one ounce of gold. The certificate itself is not physical gold but a promise that the holder of this certificate will receive a specified amount of gold from a designated place, such as a bank or a gold repository.

Now you can use this gold certificate to buy goods or services. For example, if you want to buy a bicycle, you can give the seller the gold certificate. The seller accepts the certificate because he trusts that he can later redeem it at the bank or gold repository for an actual ounce of gold.

In this way, the gold certificate represents the value of the gold. It facilitates trading without physical gold actually having to change hands.

Banknotes and coins can also take on the role of the gold certificate in the above example. Suppose, instead of a gold certificate, you have banknotes issued by the bank that represent the value of a certain amount of gold (e.g. 1,000 US dollars for a gold bar). These banknotes can then be used as a means of payment to buy goods or services. The seller accepts the banknotes because they trust that they can redeem them at the bank for the equivalent value in gold if needed.

The money itself has no intrinsic value but represents the value of the underlying asset and is used as a medium of exchange.

Banknotes proved to be not only much more convenient but also allowed people to, for example, spend a dollar bill for a cup of coffee without having to cut their gold bar into a thousand pieces. If they wanted their money back, they simply brought the dollar bills back to the bank to redeem them for the actual form of money, in this case, the gold bar, whenever they needed it. In this way, paper began to be used as a practical and convenient means of payment.

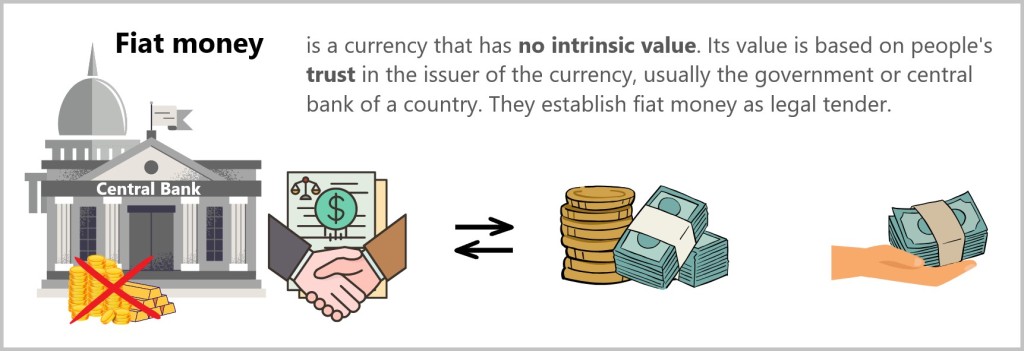

1.4. Fiat money

However, in the 20th century, a combination of economic and political factors led to the severance of this link between paper money and the gold it represents.

During the two World Wars, many countries had to use a large portion of their gold reserves to cover the costs of the war. To inject more money into circulation, some countries temporarily abandoned the gold standard. This led to increased inflation and currency instability.

During economic crises like the Great Depression or economic downturns, countries couldn’t effectively and flexibly respond due to the rigid monetary constraints of the gold standard. This led to prolonged recessions and increased unemployment.

After the Second World War, the global economy again experienced strong growth and an increase in international trade. However, the strict limitations of the gold standard proved to be detrimental to the flexibility of monetary policy to respond to such economic changes.

From a political point of view, the gold standard was seen as a restriction that limited governments‘ freedom of action and prevented them from pursuing a proactive economic policy.

It suffices to say that governments assured their citizens that they themselves would guarantee the value of this paper money. Society agreed to trade with paper money based solely on the promise of governments. Thus, the so-called fiat currency emerged.

Fiat money is money that derives its value not from a physical asset such as gold or silver, but from the trust and acceptance of the people and the authority of the government that issues it. A simple example of fiat money is the paper money or coins we use every day. The value of these bills and coins is supported by the trust that they are accepted as a means of payment and guaranteed by the government that issues them. As long as people have confidence in the stability and value of fiat money, it retains its value and function as a medium of exchange.

A compact yet comprehensive explanation and overview of this topic is provided by the video contribution „What is money? The value of money explained simply” by Finance Fellows.

2. The Fiat system – Alice in Wonderland

„It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Henry Ford

Over time, the trust model has changed – from the trustworthiness of a material object such as gold to trust in institutions such as central banks.

In the fiat system, governments determine the value of a currency and declare it as legal tender. It is the government’s responsibility to decide whether a medium of exchange is recognized for financial transactions, commercial settlements, or general trade within a country or jurisdiction.

The fiat banking system includes a range of banks, including central banks and commercial banks, as shown in the following figure.

The central bank is the highest banking authority in a country and is responsible for managing monetary policy and regulating the money supply in circulation. It is the only institution authorized to issue legal tender. The central bank influences the flow of money by setting interest rates, printing money or withdrawing it from circulation, and implementing other monetary policies to promote the stability of the currency and the economy. This also includes monitoring the banking system. Central banks are usually established and supervised as independent institutions by a country’s government. They often collaborate with other government agencies and international institutions to support economic stability.

Commercial banks are private banks that provide financial services to individuals, businesses and other organizations. They accept deposits, grant loans, facilitate transactions and offer other banking services. These banks use the currency units issued by the central bank to conduct business and settle transactions.

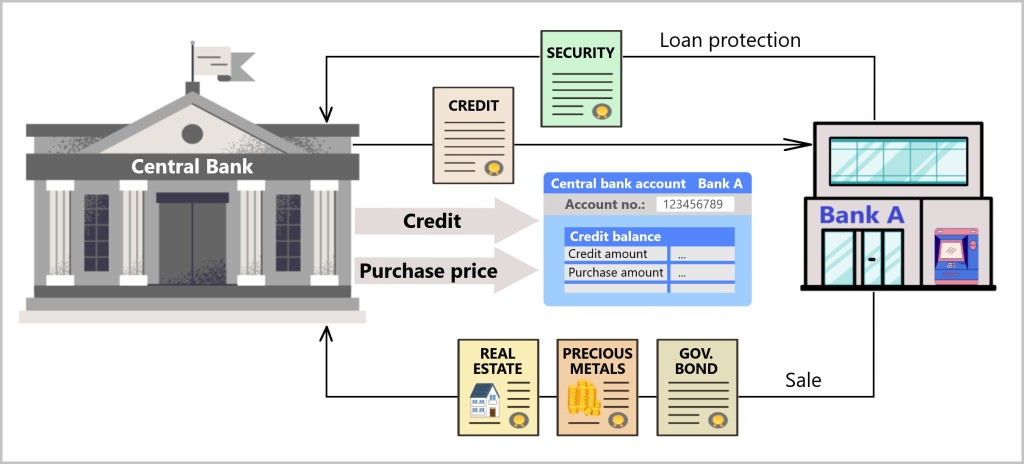

Each commercial bank is required to maintain an account with the central bank, known as a central bank account. In this account, the commercial bank has a credit balance that it can use to receive cash from the central bank or to transfer cash to it. This credit balance, along with the physical cash issued by the central bank, is collectively referred to as central bank money, as it is exclusively created by the central bank.

The central bank balances of commercial banks can arise in various ways. On the one hand, the central bank grants these banks loans, which are then recorded as credit balances on the commercial bank’s account. In order to receive these loans, the commercial banks must deposit collateral such as securities and pay interest on them.

Securities are papers that represent a certain value. They can include, for example, stocks, bonds, or investment fund shares.

Stocks are shares in a company. When you buy a stock, you own a small part of that company.

Bonds are debt securities. When you buy a bond, you are lending money to the issuer (such as a government or a company) and, in return, receive interest payments and the borrowed money back at a later date.

Investment fund shares are part of a fund that is managed by a fund manager. This fund invests the money of many investors in a variety of securities in order to spread the risk.

On the other hand, central bank balances can also arise when the central bank acquires assets such as real estate, government bonds, or gold from commercial banks. In this case, the central bank credits the purchase amount to the account of the respective commercial bank.

Additionally, commercial banks are required to maintain a minimum balance on their central bank accounts, known as the minimum reserve. This minimum reserve is determined by the central bank. It calculates this by summing the deposits across all commercial bank accounts and multiplying this total by a specified percentage.

The function of a central bank balance is to enable commercial banks to provide cash to their customers when needed. For example, when customers want to withdraw money, commercial banks must ensure they have enough cash reserves to meet this demand. This requires commercial banks to access and utilize their balances with the central bank to procure cash.

Furthermore, the central bank balances of commercial banks are needed for non-cash payments between banks. When one commercial bank wants to transfer money to another commercial bank, this transaction is typically settled through their balances with the central bank.

Fiat Lux – Money out of Nothing

In reference to the biblical phrase „Fiat Lux”, the term „Fiat money” refers to money being created „out of nothing” in a sense. The following explanations illustrate this process.

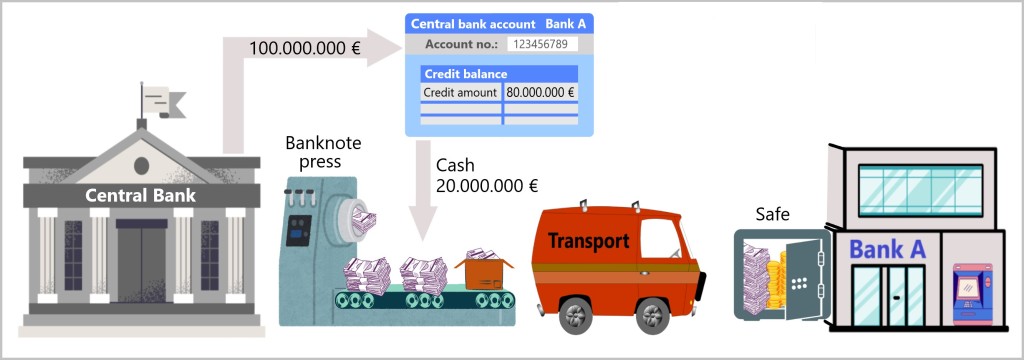

2.1. Primary money creation

The process begins with a government mandate. Suppose the government decides to inject an additional 100 million euros into circulation to stimulate the economy. The central bank is responsible for implementing this mandate, for example, by providing this amount to commercial banks as credit. This increases the credit balance on the commercial banks‘ central bank accounts. They can then withdraw a portion or the entire sum in cash from their central bank accounts. To provide the additional cash, the corresponding banknotes are subsequently printed and transported to the vaults of the commercial banks using cash transporters.

The 100 million euros are literally created out of nothing, as they are not backed by an intrinsic value such as gold or silver. But that’s just the first part of the money creation chain.

2.2. Secondary money creation

As already mentioned, commercial banks act as intermediaries between the central bank and the general public within the fiat financial system. They accept deposits from individuals and companies and hold a portion of these deposits in reserve. The banks use the rest to grant loans and earn interest income. In this way, the banking system plays an important role in the creation and distribution of money in the economic cycle.

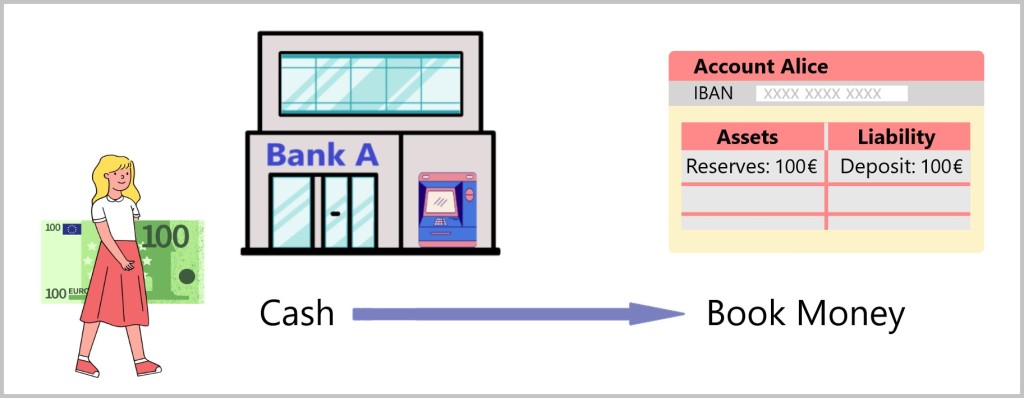

2.2.1. Secondary money creation via customer deposits

Suppose Alice has received EUR 100 in cash from her grandmother for her birthday. As she doesn’t want to carry the cash with her all the time, she decides to deposit it in her bank account at Bank A. This converts the cash into book money, also known as scriptural money.

The bank books Alice’s deposit on the liabilities side of its balance sheet. For the bank, this deposit represents a liability, as it owes Alice EUR 100 in cash. To balance the balance sheet, the bank posts the EUR 100 to its reserves. As a result, the EUR 100 are physically deposited in the bank’s vault and increase the bank’s assets.

In most jurisdictions, a bank deposit is not considered a security deposit. This means that the money deposited no longer remains in the customer’s possession. Instead, the money becomes the property of the bank and the customer receives in exchange an asset known as a deposit account (current or savings account). This deposit account is shown as a liability on the bank’s balance sheet. In simple terms, this means that a customer effectively gives their money to the bank, which keeps it in its possession. In return, the customer receives a promise from the bank to get their money back at a later date or as required. This promise is usually documented by the customer’s deposit account, which is a liability of the bank.

As the money now effectively belongs to the bank, it uses it to make a profit by lending it out further. This is where the concept of fractional reserves comes into play. Minimum reserves are an essential part of banking and are applied worldwide. It states that banks that accept deposits from the public must only hold a portion of these deposits as a reserve in liquid assets. These bank reserves can be held either as cash in the commercial bank’s vaults or as balances in the commercial bank’s account with the central bank. As described above, the central bank of a country has the power to determine a fixed amount of reserves that banks must hold. This amount is referred to as the „reserve requirement” or „reserve ratio”. [Fractional-reserve banking]

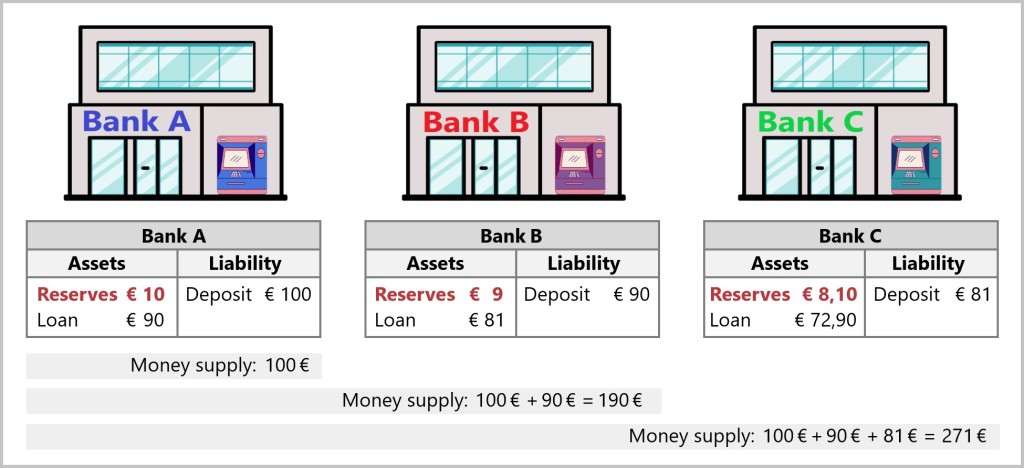

In our example, we assume that the minimum reserve ratio is 10%. This means that Alice’s bank can grant an amount of EUR 90 as a loan. If the borrower buys a bicycle with this EUR 90 and transfers the money to the bicycle seller’s account at Bank B, Bank B has a liability to the bicycle seller in the amount of EUR 90. In order to balance its balance sheet, Bank B transfers this EUR 90 as a reserve, which it books as part of its assets.

The original EUR 100 in cash has now become EUR 190 in book money. After the next cycle, this will become EUR 271.

After each new round of lending, the amount of book money increases. With a minimum reserve ratio of 10%, up to EUR 1,000 of book money can be created from EUR 100 of central bank money (in the form of cash).

The maximum amount of book money that can be created out of nothing depends on the minimum reserve ratio. The money creation multiplier is calculated as follows:

This example demonstrates the secondary creation of money from customer deposits at commercial banks. How this process takes place in the case of lending can be illustrated as follows.

2.2.2. Secondary money creation through lending

Suppose Alice’s family wants to buy a house and applies for a loan of EUR 100,000 from their commercial bank. The bank approves the loan and posts the amount of EUR 100,000 to the family’s bank account. In this scenario, the bank does not use the money from its customers‘ deposits, but borrows it from the central bank.

With a minimum reserve ratio of 10%, the commercial bank only needs EUR 10,000 in central bank money to grant a loan of EUR 100,000 in the form of book money. This creates an additional EUR 90,000 in book money out of nothing. The bank books the loan amount on the assets side of its balance sheet, which means that the bank recognizes the claim to repayment of the loan as an asset on its balance sheet. The bank can therefore use part of the approved loan as a basis for granting new loans. This creates new book money, as the bank grants loans that exceed the original deposit. This process is known as the multiplier of lending and contributes to the expansion of the money supply in the economy.

The family can now pay tradesmen and construction companies, who in turn buy building materials and pay wages to their employees. The book money is then transferred to other commercial banks, which can lend it again according to the principle described in chapter 2.2.1.

All in all, this means that considerably more money can be lent than was originally put into circulation.

2.3. The influence of central bank policy on the money supply

By defining the minimum reserve ratio, the central bank can indirectly influence the book money supply.

In addition to the minimum reserve rate, the central bank can influence monetary policy through the so-called key interest rate. The key interest rate is the interest rate at which commercial banks can borrow money from the central bank. If the central bank lowers the key interest rate, the supply of credit is increased and the economy is stimulated, as it becomes cheaper for commercial banks to borrow money and pass it on to companies and consumers. When the central bank raises the prime rate, this usually dampens inflation by making it more expensive to borrow money, which reduces consumer spending and business investment. The prime rate therefore has a significant impact on borrowing costs, the availability of credit and therefore the overall economic environment. That’s the theory, at least.

A minimum reserve of 10% was assumed in our calculation examples. The European Central Bank (ECB) stipulates a minimum reserve of just 1%.

Conclusion: Fiat money is created through a combination of government authority, central bank action, commercial bank lending and fractional reserve banking. It is based on trust in the government and the financial system, not on an intrinsic value of the currency.

2.4. The risks of loose monetary policy and its effects

Some consider this dynamic as a collective illusion. But what is this claim based on?

Central banks, by controlling the money supply and influencing interest rates, can lead to over-lending and excessive debt through loose monetary policy. The fiat money system allows banks to lend substantial amounts without adequate collateral or risk assessment, leading to an increase in risky loans.

This practice enables the creation of complex financial products that can spread and obscure risks, increasing the vulnerability of the financial system to shocks. Additionally, government bailout actions incentivize risky behavior, as banks and financial institutions may assume they will be supported in case of trouble, leading to excessive risk-taking and engagement in risky transactions.

A balanced money supply in circulation is considered a crucial driver of economic growth. However, a rapid increase in the money supply without corresponding real economic growth can lead to overvaluation of assets such as stocks, real estate, or commodities. This poses the risk of asset bubbles, the instability of which can manifest in the long term and lead to sudden price corrections or economic turbulence.

Such a scenario emerged in the first few years of this century. For a long period of time, commercial banks speculated that residential real estate prices in the USA would rise inexorably. A loose monetary policy with low interest rates and generous lending made it possible for even people without a regular income to obtain real estate loans. The banks regarded the residential properties they financed as the sole collateral for the loans, which boosted demand for real estate and drove prices up irrationally.

An economic downturn, accompanied by interest rate hikes by the US Federal Reserve, meant that more and more borrowers were no longer able to service their rising home loan installments. This forced a growing number of people to sell their properties, which in turn led to a collapse in property prices. However, as these properties served as collateral for the loans granted, the house of cards collapsed and the commercial banks suffered massive financial losses.

Trust between the banks was shaken, causing them to stop lending money to each other. As a result, the renowned investment bank Lehman Brothers was unable to refinance itself, became illiquid and went bankrupt. This chain reaction not only spread to the banking system, but also had an impact on the real economy. Companies suddenly found it difficult to obtain credit and the consequences were inevitable.

Due to the global interconnection and digitalization of the financial system, the shockwaves of this crisis quickly spread around the world. The crisis in one area of the financial system could quickly spill over into other areas, thus increasing the danger of system-wide risks.

Conclusion: The structure of the fiat money system facilitated the global financial crisis of 2007-2008, which led to a loss of confidence in the financial system and serious economic consequences worldwide.

To counteract this severe crisis, both the European Central Bank (ECB) and the US Federal Reserve (FED) intervened massively, lowering the key interest rate to zero percent over extended periods. Their goal was to facilitate commercial banks‘ access to central bank money, circulate it in the form of book money, and stimulate the economy by granting new loans.

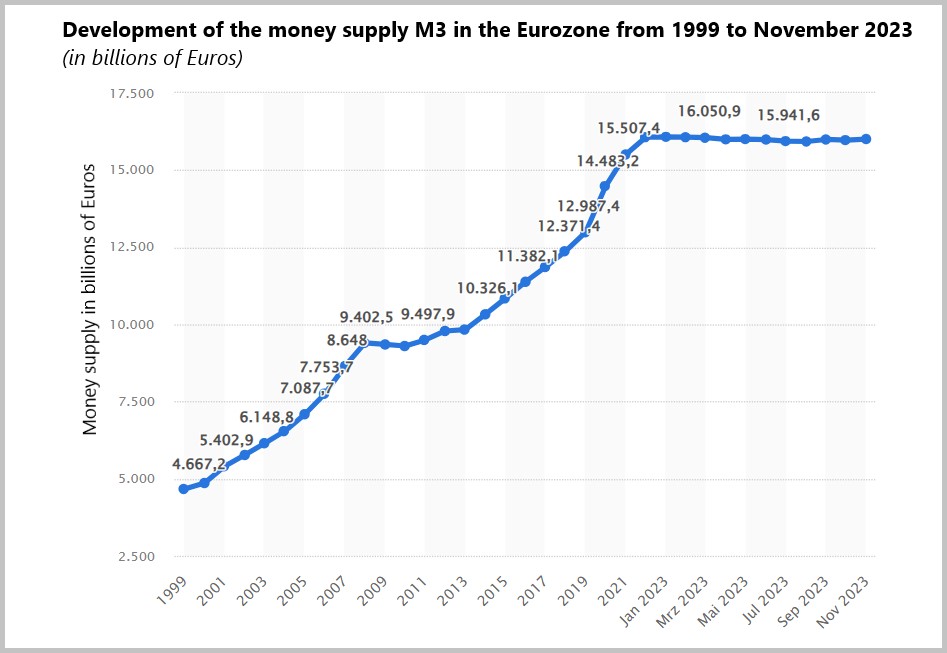

As a result of this policy, the money supply M3 in the Eurozone has continuously grown over the past 20 years – from 4.67 trillion EUR in 1999 to over 16 trillion EUR in 2023.

The money supply M3 is a measure of the total money available in an economy that is readily accessible. It includes not only cash and coins but also money in bank accounts, savings deposits, short-term investments like money market funds, and similar liquid assets. This broader definition allows for capturing the overall liquidity of an economy, meaning how much money is available in total for purchasing goods or making investments.

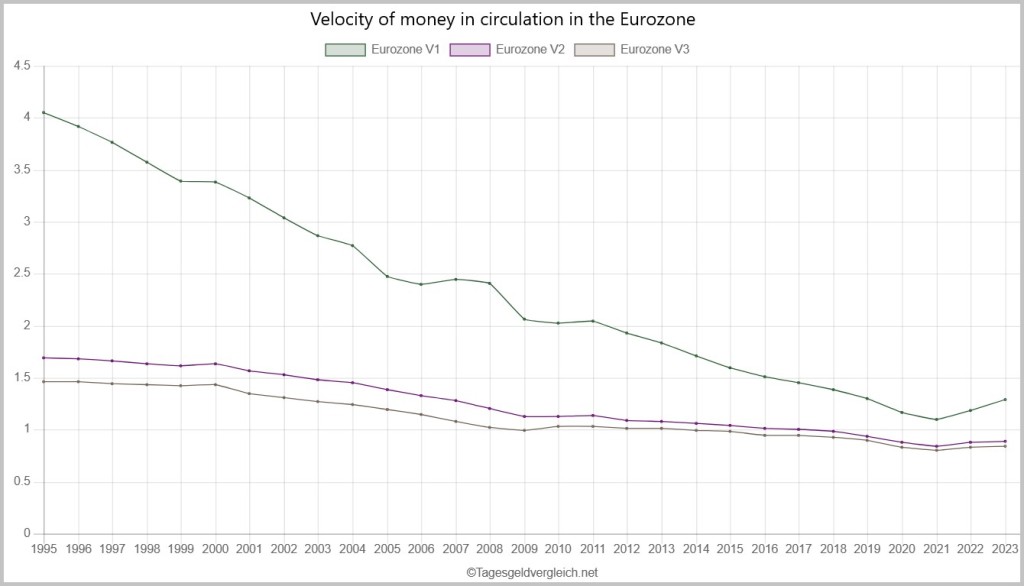

However, the velocity of money circulation in the Eurozone has decreased over the past 20 years, which can be attributed to various factors. These include the impacts of the 2007-2008 financial crisis, changed credit conditions, the monetary policies of the European Central Bank (ECB), as well as structural changes in the economy.

In macroeconomic terms, the velocity of money is an important indicator of the activity and pace of economic activity in a country or economic region. It shows how quickly money circulates through the economic system and how efficiently it is used for the purchase of goods and services.

A high velocity of money in circulation often indicates a vibrant economy where many transactions take place and money is passed quickly from one hand to the next. This can be a sign of a high level of economic activity and growth. A faster velocity also means that the same money is used more often, which increases the multiplier effect and helps to increase gross domestic product (GDP).

On the other hand, a low velocity of money can indicate economic problems. If money circulates slowly and transactions decrease, this can be a sign of economic stagnation or lower demand for goods and services. This can lead to deflationary tendencies and affect economic activity.

A decreasing velocity of money alongside an increasing money supply can pose a challenge for central banks, as this could indicate that monetary policy measures are becoming less effective. In such a situation, central banks may consider additional measures to increase the velocity of money and stimulate economic activity.

A decline in the velocity of money could indicate a loss of confidence in the financial system or the general economic situation, leading people to hoard their money or reduce consumption.

Conclusion: The effectiveness of central banks‘ monetary policy measures is reaching its limits and points to structural problems in the existing financial system.

2.5. The digitalization trend

The evolution of money goes hand in hand with the progress of technology. The rapid advancements in areas such as computer technology, the internet, smartphones, wireless communication, and artificial intelligence have made this relationship increasingly complex. These technological advances have contributed to the predominance of digital forms of money in modern societies, supported by complex financial systems and digital transactions. Physical cash is increasingly being replaced by digital alternatives such as debit and credit cards, electronic wallets or apps, as well as digital deposits at commercial banks.

Since 2020, many of us have become aware that we are living in a time of change, bringing comprehensive transformations that affect society as a whole. The ongoing digitalization across industrial, public, and private sectors has further increased the acceptance of digital currencies. Digitalization also amplifies the concentration of power and data in the hands of a few large financial institutions or technology companies. This raises risks associated with monopolistic practices and data privacy.

In parallel, the use of algorithmic trading strategies and high-frequency trading in financial markets could lead to unpredictable price fluctuations and more volatile markets, increasing the risk of financial crises. Digitalization has heightened the complexity and opacity of the financial system, especially in the realm of derivatives and structured financial products. This complexity could make it more challenging to detect and manage financial crises.

Derivatives are contracts that derive their value from the price of other things. There are various types of derivatives, but two of the most common are options and futures. Imagine you go to the market and buy an apple. You know the price for an apple is 1 euro. Now, imagine you could enter into a contract that gives you the right to buy that apple at the same price in a week, regardless of how the price may change in the meantime. That’s an option. A future would be placing an order for an apple at a fixed price, but the delivery is scheduled for a week later. In both cases, people are seeking to hedge against or profit from price changes without immediately buying the apple.

Now, imagine you’re in a candy store and you want to buy a variety of candies, but you don’t want just one type. So, you ask the store owner to put together a bag with a mix of different candies. Structured financial products are similar. Banks and financial institutions bundle various types of investments like loans, mortgages, or debts and then sell them as a package to investors. These packages have different parts with varying risks and returns. Some parts are safer, while others are riskier. The idea is that investors can choose which parts to invest in, depending on how much risk they want to take. These packages can be very complicated, and sometimes even experts don’t fully understand what’s inside. This can lead to problems if things don’t go as planned.

Conclusion: The trend towards digitalization exacerbates the structural weaknesses of the fiat financial system and poses new complex challenges for regulatory authorities to ensure the long-term stability of the financial system under these conditions. This raises the question of how the existing fiat financial system should be further reformed.

Technological development has led to the parallel emergence of a new type of currency, the cryptocurrency. Cryptocurrencies are digital or virtual currencies that are based on cryptographic techniques and serve as a means of exchanging value. Unlike traditional currencies, cryptocurrencies are not controlled by governments or central banks. Instead, they are managed via a decentralized computer network. They use strong encryption techniques and complex algorithm-based processes to secure transactions, ensure independence from central authorities and regulate the creation of new units. Well-known examples of cryptocurrencies are Bitcoin, Ether and Tether.

Supporters of cryptocurrencies view Bitcoin as a trailblazer for the separation of state and monetary systems, considering this development as one of the most significant revolutions of all time. In fact, since its inception in 2009, Bitcoin has paved the way for the development of numerous other cryptocurrencies and blockchain projects.

Conclusion: These novel structures upon which cryptocurrencies are based represent another serious challenge to the traditional fiat money system.

Given these challenges, the statements made by Christine Lagarde, President of the ECB (European Central Bank), and Fabio Panetta, Member of the ECB Executive Board and Chair of the High-Level Task Force for a Digital Euro, appear rather „mild”.

„We need to prepare our currency for the future. We envisage a digital euro as a digital form of cash that can be used for all digital payments, free of charge, and that meets the highest privacy standards. It would coexist alongside physical cash, which will always be available, leaving no one behind.” [Christine Lagarde]

„As people increasingly choose to pay digitally, we should be ready to issue a digital euro alongside cash. A digital euro would increase the efficiency of European payments and contribute to Europe’s strategic autonomy.” [Fabio Panetta]

At present, non-banks such as private individuals and companies only have access to central bank money via cash. All cashless transactions are processed exclusively via the book money of commercial banks. With the introduction of the digital euro, however, cashless transactions for the general public will also be possible directly with central bank money. As a result, central bank money will be integrated into the entire economic cycle in addition to the commercial banks‘ book money. This suggests that the introduction of the digital euro as a means of payment for non-banks will be accompanied by a profound structural change to the current fiat money system.

From this perspective, the controversial discussions about the introduction and design of the digital euro as a CBDC (Central Bank Digital Currency) are also understandable given its societal relevance.

From the perspective of the average citizen, the question arises: Will central bank digital currencies make our lives easier and safer, or is it a risky experiment?

Before delving deeper into the discussion, it’s important to note that both CBDCs and cryptocurrencies are part of the digital currency revolution. Some key technological elements used in cryptocurrencies can also be employed in CBDCs. These fundamental elements directly impact the characteristics and practical application of CBDCs.

To get a better understanding of CBDC, we will take a closer look at some key elements of the most popular cryptocurrencies in the next chapter.

3. Cryptocurrencies – All roads lead to Rome

„Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.“

Satoshi Nakamoto, Post im P2P-Foundation-Forum

The financial crisis of 2007-2008 played a decisive role in the emergence of cryptocurrencies such as Bitcoin. It led to a loss of confidence in traditional financial institutions and the existing fiat money system. Many people were disappointed by the response of banks and governments to the crisis and looked for alternative ways to store their money and conduct transactions that were free from government control and interference.

Bitcoin was created shortly after the outbreak of the financial crisis in 2008 by an anonymous person or group with the pseudonym Satoshi Nakamoto. Bitcoin’s whitepaper, published in the same year, presented an idea for a decentralized digital currency that works without a central authority or intermediaries. This concept came at just the right time, when confidence in the traditional financial system was shaken. The financial crisis of 2007-2008 therefore served as a catalyst for the emergence of cryptocurrencies, as it raised awareness of the weaknesses of the existing financial system and highlighted the need for alternative ways to store and transact value.

Cryptocurrencies have the potential to influence and transform the traditional monetary system. To understand why this is the case, we will first explain some basic terms in this context without digressing into technical details.

3.1. Distributed Ledger Technology (DLT)

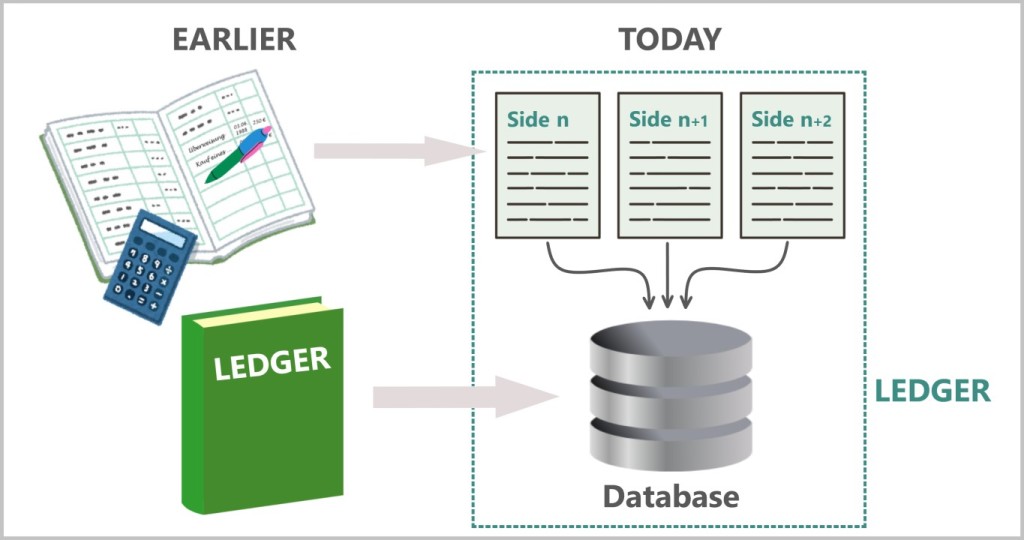

A ledger is a term from the world of accounting and finance that generally refers to a record of financial transactions in the form of a book or database. It is used to record the current status of assets, liabilities and capital of a company or organization. A ledger can be kept either manually or electronically and typically contains entries on income, expenses, transfers and other financial transactions.

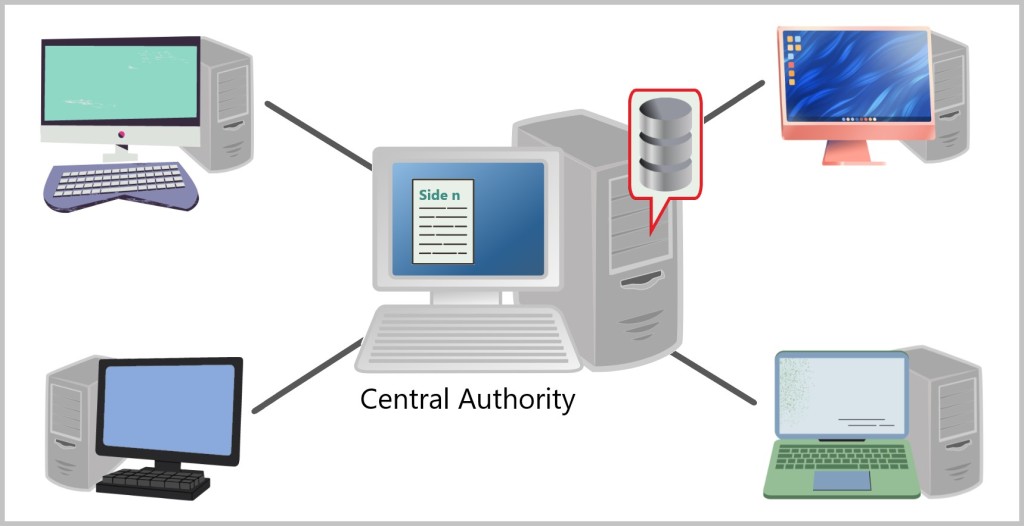

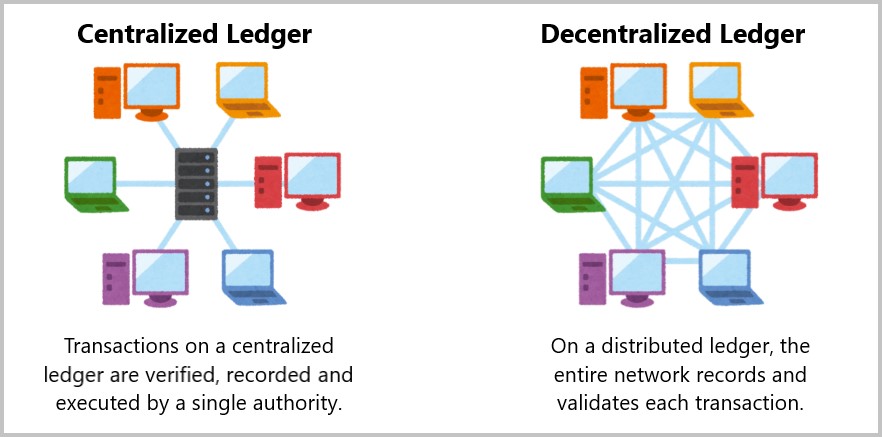

A traditional ledger is usually centralized, which means that a central authority has control over the data and also centrally controls access to it. This centralization makes traditional ledgers more susceptible to fraud or data manipulation, as they are controlled by a single entity.

A distributed ledger is a decentralized database that stores and synchronizes transaction data across multiple locations. Unlike centralized ledgers, which are managed by a single central location, the data in a distributed ledger resides on many distributed nodes or computers that are connected via a network. This decentralized nature ensures greater security as the data is stored on multiple nodes and changes are cryptographically secured.

In summary, the main difference between a traditional ledger and a distributed ledger lies in their centralized or decentralized structure, which has implications for the control, security and efficiency of data tracking.

A centralized ledger requires an authority (bank, cloud, etc.), while distributed ledger technology enables P2P-exchange via computers. (Peer-to-peer (P2P) is a concept that describes a direct interaction or communication between participants in a network without the need for a central intermediary). [iMi Blockchain]

3.2. Blockchain-Technology

Distributed ledger technology (DLT) and blockchain technology are closely related, as blockchain is a specific implementation of DLT. DLT can be implemented in various ways in practice, with blockchain technology being the best known and most widespread form. DLT and blockchain technology are often equated, but blockchain is merely a specific variant of DLT.

You can think of the blockchain as a long, public notebook (ledger). Each page of this notebook represents a block. Within this notebook, all transactions ever made are recorded.

Each block contains a list of transactions, such as someone sending money to someone else. Once a page of the notebook is full, a new page is added, and this is linked to the previous page. This linking is like a chain that holds all the pages together – hence the name „blockchain”.

In order to understand the basic operating principle of blockchain technology, it is important to understand how a system is set up that allows all participants to create, verify and update data.

Peer-to-Peer (P2P) Network

A peer-to-peer (P2P) network is required to operate a blockchain. This is a network of computers known as nodes, all of which have equal rights. Anyone can join this network (see Figure 17). The P2P network enables the nodes to communicate with each other, exchange information and perform tasks without the need for a central server. These P2P networks can be set up via the global Internet infrastructure, where computers are directly connected to each other.

Cryptography

As anyone can join the network, including potentially harmful actors, it is crucial that communication between nodes is secure and unaltered. Cryptography plays a central role here. It enables secure communication in an environment where potential threats exist. Encryption converts information in such a way that it can only be read by participants who have the corresponding „keys” for decryption. In this way, messages can be transmitted securely without unauthorized persons being able to intercept or alter them. This also makes it possible to prove the authenticity of your own messages, even if there are potentially malicious actors in the network.

In Figure 18, the entry in the „Hash” field represents a cryptographic checksum or fingerprint of the data in the block, while the entry in the „Prev” field (previous hash) is the hash value of the previous block in the blockchain. The use of cryptographic hash functions ensures that the integrity of the blockchain is maintained and that changes to past blocks can be easily detected.

Consensus algorithm

The third element is the consensus algorithm. This is like a rule or procedure that ensures that all participants in a system agree on which data is valid and how it can be changed. In a decentralized network like the blockchain, many different nodes or computers communicate with each other. The consensus algorithm helps these computers to agree on a common view, even if they might have different information. This allows them to ensure that the data they receive is correct and that everyone in the network agrees on what to do with this data.

There are various consensus algorithms used in blockchain networks to ensure that all participants agree on which transactions are valid and which are not. Each of these consensus algorithms has its own advantages and disadvantages and is selected according to the requirements and objectives of the blockchain network. The Proof-of-Work (POW) algorithm gained particular fame with the first cryptocurrency Bitcoin.

Proof-of-Work (PoW) Algorithm

What happens with the PoW algorithm? Newly added transactions are recorded in a new block. Before this block can be added to the blockchain, its content must be validated and confirmed. As soon as the block is full, the PoW algorithm is activated.

In this algorithm, a computer in the network must successfully solve a puzzle (complex mathematical task) in order to validate the content of the new block. The solution to this task is called a Proof-of-Work. As soon as a computer in the network has successfully solved the puzzle and proposed a new block for connection to the blockchain, this block is checked and validated by the other computers in the network. Each computer in the network applies the rules of the Bitcoin protocol to ensure that the transactions are valid and that the new block complies with the consensus rules. These rules include checking factors such as the validity of signatures, the correctness of the transaction data and the accuracy of the Proof-of-Work.

If the other computers in the network determine that the new block is valid, it is added to the blockchain and the transactions in it are confirmed. If the block does not meet the consensus rules or the transactions are invalid, the block is rejected by the other computers in the network and the process starts again to find another valid block.

In the Proof-of-Work (PoW) algorithm, as used in Bitcoin, several computers in the network compete with each other to solve this complex mathematical task. Solving the task requires a lot of computing power and energy.

In Figure 18, the entry in the „Nonce” field (an abbreviation for „Number used once”) represents a random number that is processed together with other data in a block to generate a hash that must meet certain criteria to be accepted as a valid block. This value is directly linked to the PoW algorithm.

Reward and punishment

For the proper operation of a decentralized blockchain, another concept from game theory comes to the forefront: „reward and punishment”. In game theory, the term „reward and punishment” refers to the incentives given to players to encourage or discourage certain behaviors. Rewards can be positive incentives that players receive when they perform certain actions or achieve certain goals. Punishments are negative incentives that players suffer when they perform undesirable actions or violate certain rules. These rewards and punishments are used to influence player behavior and encourage the achievement of in-game goals.

This rewards participants who help maintain the records in the blockchain and add new blocks to the blockchain. In the case of Bitcoin, this reward means that a token, or virtual coin, is awarded every time a consensus is reached and a new block is added to the chain. On the other hand, malicious actors who try to circumvent or manipulate the system lose the computing power spent during the Proof-of-Work process, or risk losing their coins.

In conclusion, it is important to recognize that the punishment and reward system has an impact on psychological behavior. It changes the rules of the system from something you have to follow to something you want to follow because it is in your own interest to do so.

Critical P2P-network size

In reality, a blockchain is considered decentralized if it has enough independent validators or nodes that validate the transactions. These nodes are spread across different geographical locations and no single party has control over the network.

A summary of the key features of blockchain technology can be found in this video.

A more detailed visual demonstration of the functionality of a blockchain using the example of financial transactions can be found here and here.

The key strategic benefit of using blockchain technology to solve problems lies in its decentralization. The selection of blockchain technology as a solution method is only justified if the underlying problem is actually due to centralization. If decentralization is not required or desired, it is likely that a centralized solution is more suitable and blockchain technology is not necessary.

The central question is: Is our world currently ready for the comprehensive implementation of complex blockchain technology that entails decentralization?

3.3. The Token – The Swiss Army Knife

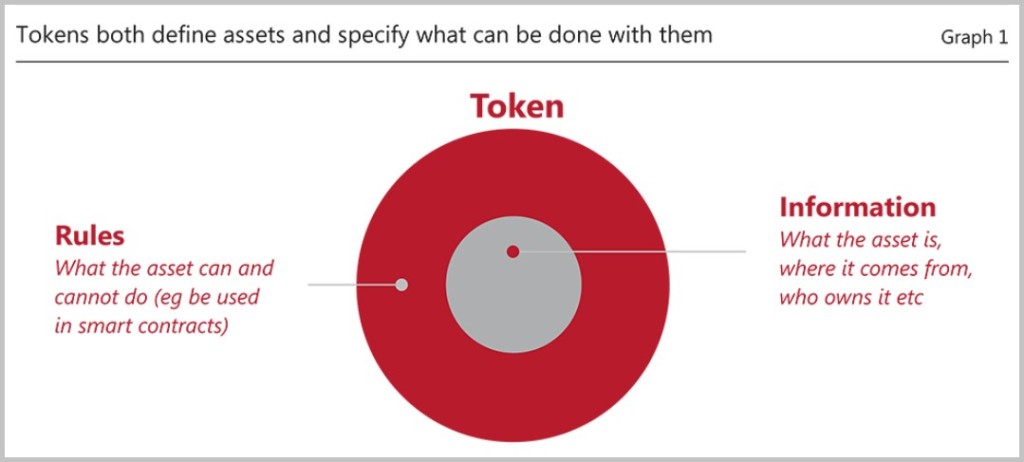

When explaining the reward mechanism as an essential component of a blockchain in the previous chapter, the term „token” was used. It makes sense to explain this term in simple language here.

A token can appear in various forms.

Generally speaking in the IT sector, a token is a type of digital key or identifier. It is used to confirm the identity of a user or entity and gain access to a system or resource. Think of it like an ID card that you show to get into a building. For example, a token can be a password, a biometric feature (like a fingerprint) or a special code that you enter or present to authenticate yourself. It is used to ensure security and access control in IT systems.

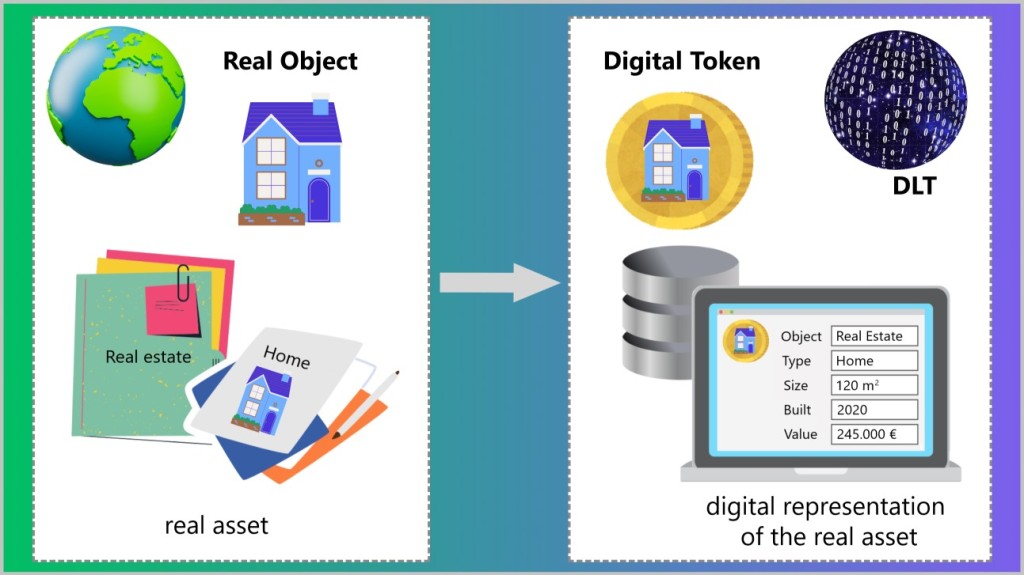

In the blockchain world, a token is a digital unit with multiple functions. It can serve as a cryptocurrency, be digital representations of fiat currencies on blockchain platforms and be used for transactions. Tokens can also be digital representations of real objects such as real estate or works of art.

A token can represent not only a digital object, but also its properties. This depends on the type of token and its implementation on the blockchain. Consider, for example, a tokenized work of art. Such a token could not only represent the artwork itself, but also contain information about the artist, year of publication, size, ownership history and even license rights.

In addition, a token can represent certain functions within a blockchain network, such as usage rights, access rights, voting rights, entitlement rights, etc. Depending on the type and intended use, tokens can have different characteristics and functionalities.

Tokens can be seen as a kind of toolkit, allowing digital objects, their properties, and various functions to be combined. These are then used as an element in a predefined algorithm on a digital platform such as a blockchain. This algorithm determines how the tokens can be created, transferred, traded, and used. This logic dictates how the tokens operate and what rules they must adhere to.

A token could metaphorically be seen as a universal tool that can be used in a variety of situations. Much like a Swiss army knife is versatile and offers different functions, a token in a blockchain network can be used for various purposes, from holding value to executing pre-programmed processes.

Further information on the topic of tokens and their role in the future financial system is provided in the following chapters.

3.4. Centralized vs. Decentralized Ledger System

Centralized Ledger System

The existing financial system is based on centralized ledger systems in which transactions and account balances are managed and monitored by a central authority or institution. Banks, central banks and other financial institutions maintain these centralized ledgers in which all transactions and account movements are recorded.

In critical situations in which trust in a central authority or institution is called into question, the following aspects of a centralized ledger system come into particularly sharp focus:

Single Point of Failure: As a centralized financial system is controlled by a single authority or institution, it carries the risk of a „Single Point of Failure”. If this authority fails or is compromised, this can lead to significant disruptions or failures in the entire system.

Lack of transparency: Since centralized general ledgers are maintained by a single institution, it is often difficult for outsiders to verify the accuracy and completeness of the data. This can be a particular problem in industries that value transparency and accountability.

Political or economic pressures: Political and economic influences can affect the trustworthiness and accuracy of centralized general ledgers. For example, a government agency could manipulate data in a centralized general ledger to achieve its own goals.

Limited accessibility: Since centralized general ledgers are often managed by a single party, access to and use of data may be restricted or denied to external parties.

Distributed Ledger System

Cryptocurrencies are based on a distributed ledger system, which offers several advantages compared to centralized ledger systems:

Decentralization: A decentralized system functions without central authority. Slogans such as „Bitcoin is the people’s money” and „Be your own bank” convey the idea of financial independence, autonomy, self-determination and personal responsibility in financial matters.

Security and trust: Cryptocurrencies such as Bitcoin use blockchain technology, which makes transactions transparent and tamper-proof. This helps to strengthen users‘ trust in the system, especially after financial crises and fraud scandals.

Anonymity and data protection: Another reason for the emergence of cryptocurrencies is the desire for anonymity and data protection in financial transactions. Cryptocurrencies generally offer a certain degree of anonymity, as transactions are pseudonymous and do not need to be linked to personal data.

Accessibility and inclusion: Cryptocurrencies can be used worldwide and enable access to financial services for people who may not have access to the traditional banking system, such as people in developing countries or people without a bank account.

The world of cryptocurrencies has become extensive and diverse, with almost 20,000 different types of crypto assets in circulation. The article „Top 10 cryptocurrencies by market capitalization” provides a classification of cryptocurrencies based on their market capitalization. In stock market terminology, market capitalization refers to the current market value of a currency or company and is calculated by multiplying the number of units by the price.

A closer examination of the top three cryptocurrencies in this ranking provides revealing insights into important relationships, characteristics and modes of operation that also play a role in the design and functioning of digital central bank currencies.

3.5. Bitcoin (BTC) – Get Rich or Die Tryin’

Bitcoin was designed to serve as a digital means of payment and store of value. It is based on a transparent ledger without a central authority and thus represents a typical use case of a decentralized ledger system based on blockchain technology (see chapter 3.1. and 3.2.). The resulting systemic advantages were discussed in chapter 3.4.

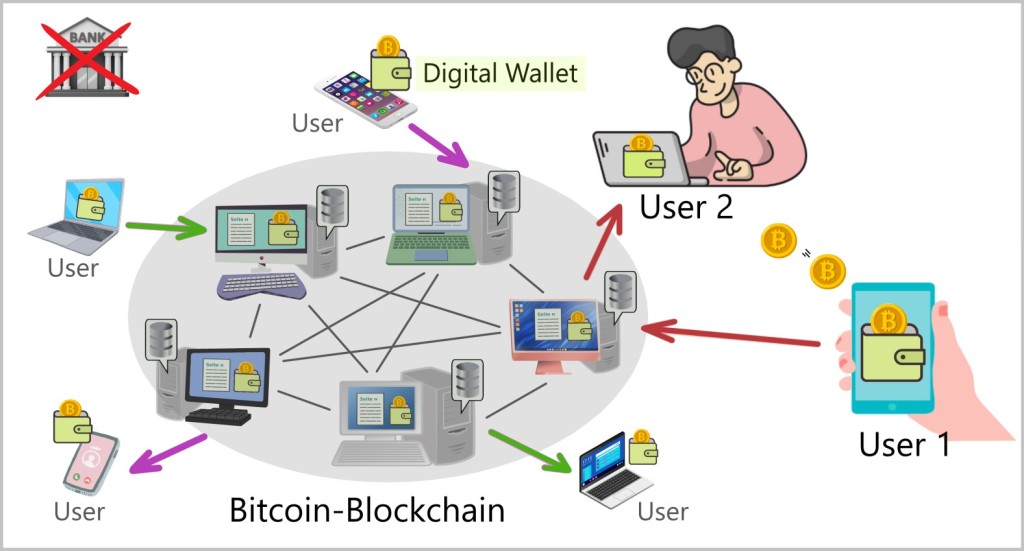

Due to its decentralized architecture, there is no single computer responsible for managing the ledger (see Fig. 21). Instead, every computer that is part of the blockchain system owns a copy of the ledger. Bitcoin uses a transparent ledger that allows every user to see all transactions and balances at any time. However, the owners of the balances and the senders and recipients of transactions are not directly identifiable. This makes Bitcoin pseudonymous, as all information is open, transparent and traceable, but the identities of the parties involved are not fully disclosed.

Bitcoin is purely digital and does not exist in physical form like traditional coins or banknotes. Instead, ownership of Bitcoin represents the right to access certain records in the ledger, known as the blockchain, and to send Bitcoin between different addresses. Since Bitcoin is not controlled by a government, authority or bank, the owner retains full control over their Bitcoin money. Only the rightful owner has access to their Bitcoin balance in their digital wallet and can dispose of it.

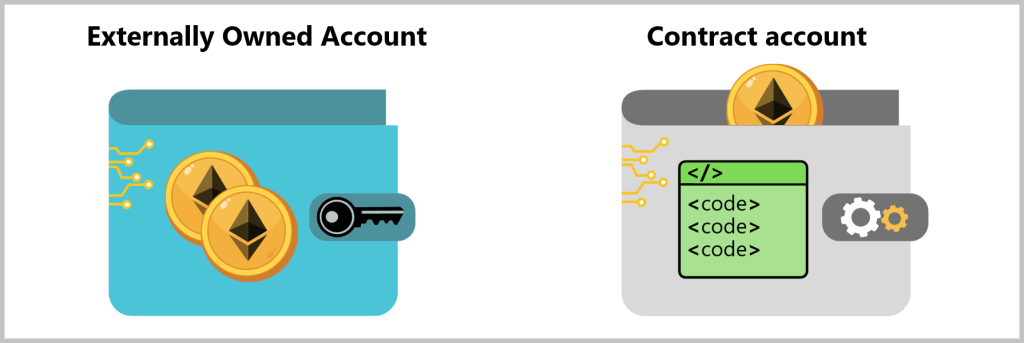

Digital wallets are electronic wallets that allow users to securely store, manage and transact with digital currencies such as cryptocurrencies. They work in a similar way to traditional wallets, but for digital currencies, and offer functions such as sending and receiving coins, viewing account balances and managing transaction histories.

By enabling direct payments between users without intermediaries such as banks, Bitcoin makes international transactions in particular much easier. This eliminates bank fees and the hassle of dealing with exchange rates.

Bitcoin, like gold, is designed to be scarce as there is a maximum cap of 21 million Bitcoins that can ever be created. For this reason, some investors view Bitcoin as a long-term investment and a hedge against inflation.

A concise yet thorough explanation of what Bitcoin is and how to use it can be found in the video „Bitcoin’s explanation: Understanding Bitcoin in just 12 minutes” by Finanzfluss.

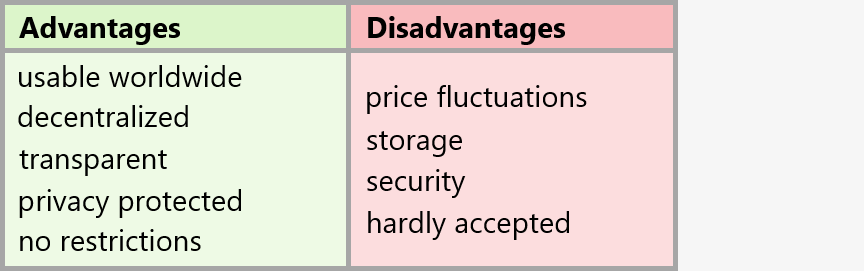

Let’s summarize the key advantages and disadvantages of Bitcoin:

In most countries, Bitcoin, like other cryptocurrencies, is not considered a legal tender. Instead, Bitcoin is often seen as a digital asset or alternative payment method. This means that the use of Bitcoin for transactions is voluntary and not required by law. However, some countries have recognized cryptocurrencies as a legal payment service or financial instrument, but not as legal tender in the traditional sense. (El Salvador is currently the only country where Bitcoin is considered legal tender, with limited success. The introduction of Bitcoin as legal currency has not improved the situation for financing and stabilizing public finances in a country where large portions of the population live below the poverty line.)

For this reason, the use of cryptocurrencies as a medium of exchange, one of the three main functions of money, is often severely restricted. This often results in cryptocurrencies having to be exchanged for a legally recognized fiat currency. This is usually done via a cryptocurrency exchange or an online trading platform. The latter often require user verification during the registration process, which at least partially compromises the advertised privacy when using cryptocurrencies.

As a virtual currency, Bitcoin does not represent real assets such as cash flow, stocks, company shares, or gold reserves. The value of a unit is determined solely by supply and demand, which can lead to significant price volatility.

In January 2024, the first so-called Bitcoin spot ETFs were introduced in the USA. These ETFs (Exchange-Traded Funds) are investment funds that are traded on an exchange and use Bitcoin as the underlying asset. They create a link between cryptocurrencies and the traditional financial world. Bitcoin ETFs offer institutional investors a legal and regulated way to participate in cryptocurrency, even if they may not be able to invest in Bitcoin directly. By buying a Bitcoin spot ETF, you are essentially buying a stake in the cryptocurrency itself.

The decision by BlackRock, the world’s largest asset manager, to enter the Bitcoin spot ETF business has already caused a stir. BlackRock manages a total of 9 trillion US dollars in assets. Even if the company were to invest just one percent of its assets in Bitcoin, this could have a significant impact on the Bitcoin price (Figure 23).

The high volatility, limited acceptance, and certain technical hurdles in handling disqualify Bitcoin as a reliable medium of exchange or store of value for large segments of the population.

What was presented to the public in 2009 as a „grassroots democratic” alternative to the „elitist” traditional banking and financial system has essentially evolved into speculation fifteen years later. Speculation involves short-term investments, where the period between buying and selling a stock is relatively brief. A speculator relies on short-term fluctuations in the stock market and attempts to predict stock price movements accurately in order to trade accordingly.

Due to the limited supply of bitcoins, the price and hence the confidence in Bitcoin can be influenced by large institutional investors such as BlackRock or Grayscale, both partners of the World Economic Forum (WEF). It is noteworthy that BlackRock also emerged as winners during the 2007-2008 financial crisis – an irony of fate in the financial world.

According to the WEF document Understanding the macroeconomic impact of cryptocurrency and stablecoin economics, „these digital currencies could be potential drivers of financial stability, equity, innovation, and market incentives for environmental sustainability”.

3.6. Tether (USDT) – Safe Haven (In God We Trust)

Tether is a cryptocurrency based on blockchain technology and designed as a so-called stablecoin. Its goal is to provide a stable value compared to other cryptocurrencies, which experience significant fluctuations in value. Typically, Tether’s value is pegged to an established fiat currency such as the US dollar, with 1 Tether usually equaling 1 US dollar. Tether Limited is the company behind Tether.

The aim is to combine the benefits of cryptocurrencies (see Fig. 22) with the stability advantages of a fiat currency. An obvious use case would be as a medium of exchange. However, stablecoins like Tether are rarely accepted for everyday purchases in the real world, as only governments can declare a currency as legal tender. Nowadays, stablecoins are mainly used on cryptocurrency exchanges. Traders use them to exchange volatile cryptocurrencies for stable ones and thereby mitigate risk. For example, investors who have invested in volatile Bitcoin and do not want to risk the Bitcoin price falling against the US dollar can simply exchange their bitcoins (BTC) for US dollar Tether (USDT) and retain the dollar value. If they later want to hold bitcoins again, they can easily exchange their USDT back into BTC. Investors can convert profits into Tether without having to leave the crypto ecosystem. They can „park” their cryptocurrencies in Tether to await value fluctuations or transfer their crypto assets without losses in value.

Tether thus assumes the function of a safe asset in the virtual crypto ecosystem. A „safe asset” is an asset that is considered a safe haven for investors, especially in times of economic uncertainty or turbulence. Such assets are usually characterized by stability, low volatility and high liquidity.

Transactions in USDT are considered both fast and cost-effective. Additionally, cross-border payments in Tether can easily transition into another target currency.

Due to these characteristics, Tether is also hailed as a bridge between the virtual cryptocurrency world and the real financial world. In the 2021 WEF article titled „Cryptocurrencies are democratizing the financial world. Here’s how”, one finds the following:

„Cryptocurrencies, such as stablecoins, which are cryptocurrencies pegged to other assets such as the US dollar, can now act as a safer and more trustworthy way of safeguarding people’s assets.

For example, if you were living in Nigeria, you would have seen your net worth drop by nearly 50% since 2016 as the Nigerian Naira dropped from roughly 200 Naira per US Dollar to nearly 400 Naira per US Dollar by the end of 2020. However, if those assets has been kept in a stablecoin like Tether (USDT), a stablecoin pegged to the US Dollar, they would have been safeguarded from any drastic devaluation.“

„Cryptocurrencies and blockchain technology, paired with the global growth of mobile and indeed internet adoption, are tempering rising financial inequalities.

And it is not inconceivable to imagine that in the coming decades, the world will have a much more democratised and accessible financial system. Financial inclusion could be achieved thanks to cryptocurrencies.“

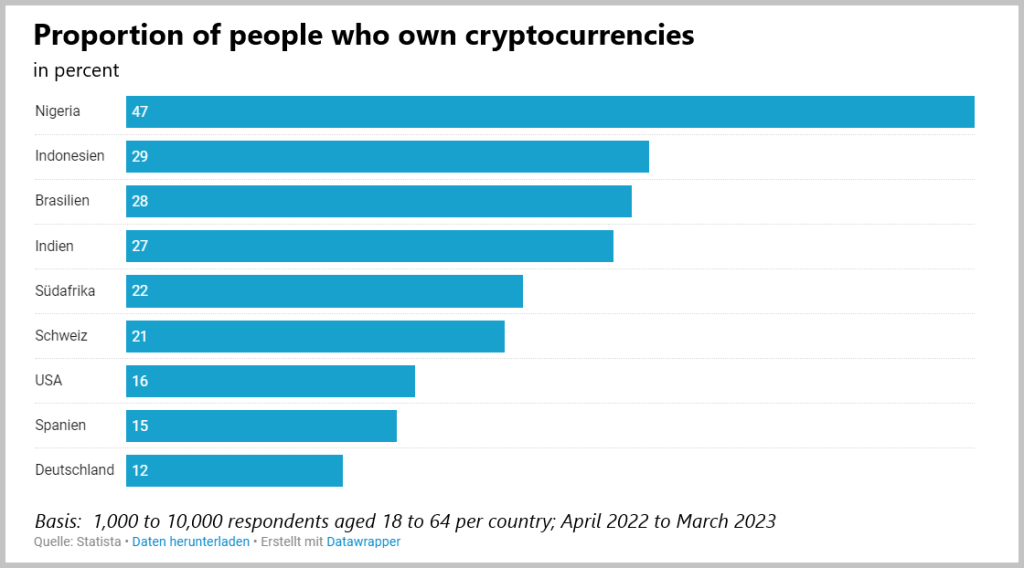

In developing countries and emerging markets in particular, where national currencies are very volatile and the banking system does not offer nationwide coverage, such concepts are gaining increasing acceptance (Figure 25).

How do stablecoins like Tether manage to keep their value stable while other cryptocurrencies are subject to strong price fluctuations?

The stability of money, whether physical or digital, relies on the trust of its users. If the market doubts the value of USDT, people will quickly sell off their USDT, leading to a price decline. To maintain this trust, companies like Tether, for example, deposit assets as collateral for their coins. These reserves serve as a guarantee that the company will uphold its promise and that its coins indeed have the specified value. In the case of Tether, each USDT is backed by US dollar reserves and other assets. In addition to fiat currencies, stablecoins can also be backed by other assets, such as gold, oil, or other cryptocurrencies.

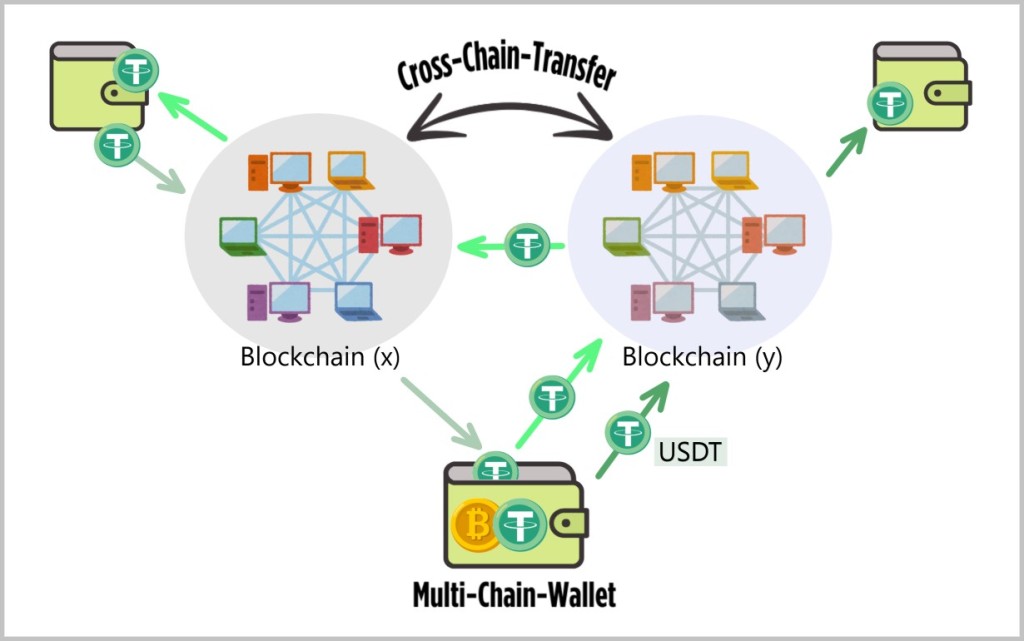

Unlike Bitcoin, Tether (USDT) does not have its own blockchain. Instead of using its own blockchain, Tether is issued on various existing blockchain platforms. As already explained in chapter 3.3., a token is generally a digital unit that is created and issued on a blockchain platform and represents a specific value or function. In relation to Tether, USDT is a token that represents the value of one US dollar. Each USDT token should therefore always have the value of one US dollar. These tokens are issued on various blockchains and can be stored, transferred and traded in wallets, just like other cryptocurrencies and digital assets.

USDT (Tether) can be considered a form of tokenized money. Tokenized money refers to the digital representation of traditional fiat currencies or other assets in the form of tokens on a blockchain.

A USDT token is typically generated through a deposit process at Tether Limited or one of its partner banks. A user sends a certain amount of US dollars to Tether Limited or deposits it in a special account. Upon receipt of the deposit, Tether Limited then issues the corresponding amount of USDT tokens backed by the deposited US dollars.

For example, if you have a multi-chain wallet, you can transfer your USDT tokens to it. A multi-chain wallet supports multiple blockchains and allows you to manage different cryptocurrencies on different blockchains in a single wallet. This allows you to carry out transactions on the supported blockchain networks.

By being able to use Tether on different blockchains, users can benefit from the different functions of the individual networks.

By being supported on various blockchains, Tether also increases the liquidity and interoperability of the currency, as it can be exchanged between different blockchain platforms. This contributes to the further adoption and acceptance of Tether, allowing users to leverage the benefits of a stable digital currency in different contexts.

However, there are also disadvantages to this structure. The company ensuring the security of the stablecoin assumes the role of a private „virtual central bank”. In the case of USDT, this is Tether Limited. In addition to the risks of misappropriation and the difficulty in proving that the company has enough assets to back the amount of coins in circulation, the question arises of how long-term adequate security can be ensured, thus maintaining public trust.

Ultimately, the question of regulation arises: Will regulatory authorities allow companies to create an asset that resembles legal tender without any supervision?

Chainalysis – Making the invisible visible

From today’s perspective, the use of stablecoins seems to be tolerated as long as it is limited to specific geographic areas and clear conditions of use are established. A report by Chainalysis titled „The 2021 Geography of Cryptocurrency Report” describes how cryptocurrencies are being introduced in some Latin American countries in response to economic hardships. The aim is to help people in Latin America mitigate their economic difficulties through the use of stablecoins. One reads:

„So many Latin American countries have economic instability, so the people there aren’t really interested in trading cryptocurrency or getting exposure to Bitcoin because it’s going to $80,000… People are trying to survive, so they need the ability to switch between their local currency and cryptocurrency to preserve its value.… Remittances are another driving force behind Latin American cryptocurrency adoption. This isn’t entirely surprising, as traditional, fiat currency remittances are hugely important to many Latin American countries. According to the World Bank, incoming remittances in 2020 represented 2.4% of GDP for Latin America as a whole, more than any other region the organization tracks besides South Asia. In countries like El Salvador and Honduras, remittances represent over 20% of national GDP. … 35% of Venezuelan households receive remittances from abroad. The Venezuelan bolivar is essentially worthless due to hyperinflation. Cryptocurrency provides a way for Venezuelans who have left to send money back, and the receivers can then hold that money in a more stable currency.”

GDP stands for gross domestic product. It is an important economic indicator that measures the total value of all goods and services produced within a country’s borders during a given period, usually a year. GDP is often used to evaluate and compare a country’s economic performance.

Chainalysis is a blockchain data platform that provides tools and research for government agencies and financial institutions. Its goal is to shape a global economy based on blockchains.

„We are paving the way for a global economy built on blockchains. Businesses, banks, and governments use Chainalysis to make critical decisions, encourage innovation, and protect consumers.”

A 70-second introduction to Chainalysis can be found here:

This brief introduction demonstrates very clearly that user privacy is essentially based on the concept of „pseudonymity”. A kind of asymmetrical protection of privacy is applied. While the majority of users do not know the true identity of a person behind a pseudonym (e.g. public address/key) and thus privacy (e.g. private address/key) is maintained, it is possible for a select group of people or institutions to determine the true identity through special knowledge and access to appropriate technologies. Therefore, pseudonymity does not offer complete anonymity, but provides a degree of privacy from the general public while allowing traceability for certain authorized parties.

This is an important point. The ability to determine the identity of a person behind a pseudonym contributes in some ways to the further concentration of knowledge and power. Individuals or organizations with the resources and technical ability to decode identity can thereby exercise increased control over the information and actions of those using pseudonyms. This can be particularly problematic if this power is in the hands of a few powerful institutions or governments, which can lead to an imbalance in terms of data protection and individual freedom.

In this regard, it’s important that the use of pseudonymity in society and in technological systems is accompanied by appropriate protective mechanisms and privacy regulations to prevent the abuse of knowledge and power and to preserve individual privacy. In most cases, governmental or regulatory institutions are responsible for establishing and enforcing privacy regulations and protective mechanisms against data misuse. These institutions are often established by the respective governments.

The use of stablecoins as virtual „safe assets” in economically challenging situations has sensitized large parts of the population in affected regions to the use of digital currencies and, in a way, prepared them for it. As a result, technological infrastructures have been developed in the background, and the acceptance and handling of virtual „safe assets” as a form of tokenized money have been tested and evaluated. At the same time, corresponding analysis and monitoring tools have also been tested and improved to ensure the necessary depth of data extraction.

The document „The Current State of Central Bank Digital Currencies (CBDCs) in 2023” by Chainalysis provides further insights into how the crypto ecosystem serves as a „sparring partner” or „training ground” in the ongoing development and evolution of the fiat financial system.

„Blockchain technology has made digital payments faster and easier than ever, and allowed for the proliferation of new cryptocurrencies for different use cases, with unique traits like decentralization, immutability, pseudonymity, and more. These innovations have demonstrated that global finance is ripe for change – and governments have taken note. Central banks across the globe have already begun remodeling financial systems for the internet age.”

3.7. Libra – The King is Dead, Long Live the King!

What would happen if a stablecoin was backed not just by one company, but by a consortium of companies including Master Card, Visa, Stripe, eBay, PayPal, Vodafone and Facebook (Meta)?

Here is a summary of a few key figures:

MasterCard and Visa: Both are the world’s best-known credit card companies offering payment services for credit and debit cards. They facilitate the electronic transfer of money between consumers, merchants and financial institutions worldwide and enable transactions in various currencies. According to statistical data for 2023, Visa leads with over 4.3 billion cards worldwide, followed by Mastercard with 3.3 billion cards. [Free credit card]

Stripe: Stripe is a leading financial technology company that provides online payment solutions and payment processing platforms for businesses. Today, millions of businesses of all sizes use Stripe to accept payments online and in person, make payouts, automate financial processes and ultimately increase revenue.

eBay: eBay is one of the world’s largest online marketplaces where people and businesses can buy and sell goods and services. eBay provides a platform for e-commerce where millions of transactions take place every day. In 2023, 132 million active customers were counted on eBay. [statista]

PayPal: PayPal is a well-known payment service provider that enables consumers and businesses to send and receive money online. It offers secure payment solutions for e-commerce transactions and enables users to transfer money electronically, pay bills and make online payments. The number of active accounts of the online payment service PayPal amounted to 426 million in the fourth quarter of 2023. [statista]

Vodafone: Vodafone is a global telecommunications company headquartered in the UK. The company is active in many countries, operating mobile networks in over 20 countries and fixed-line or broadband services in many more. Vodafone is known for its global telecommunications services, innovative technologies and commitment to providing connectivity and communications solutions to individuals, businesses and governments around the world. Vodafone currently has over 300 million mobile customers worldwide.

Facebook (Meta): Facebook is a global social network and one of the largest technology companies in the world. Facebook’s main goal is to connect people and facilitate the exchange of information, content and ideas. Facebook also offers advertising and marketing services for companies, enabling them to advertise their products and services in a targeted manner and engage with their target audience. In the fourth quarter of 2023, the number of daily active users on Facebook was just under 2.11 billion. [statista]

The combination of substantial financial resources and cutting-edge technologies within a global network of more than 4 billion users could result in privately issued cryptocurrencies seriously challenging or even partially displacing central bank and commercial bank money as a means of payment. Consequently, central banks might cede control over the payment system to a private corporate group whose network effects could be extensive, powerful, and potentially harmful. Ultimately, this could undermine monetary sovereignty and jeopardize financial stability.

In June 2019, this very scenario threatened to become reality when Facebook (now Meta) announced the project called Libra. Libra was to be a cryptocurrency backed by assets, i.e. a stablecoin. This was to serve as a means of payment for members of the global Libra Association network, which included the companies mentioned above. [wikipedia]

Was this a real revolution or just a serious message? And if so, by whom was it addressed to whom?

As essential members of the Libra Association, Facebook (Meta), Visa, MasterCard, Stripe and Paypal are all partners of the World Economic Forum (WEF).

The World Economic Forum is the international organization for public-private cooperation. It provides a global, non-partisan and non-profit platform for meaningful connections between stakeholders to build trust and initiatives for cooperation and progress. In a world characterized by complex challenges, the World Economic Forum engages political, business, academic, civil society and other community leaders to shape global, regional and industry agendas. The WEF aims to foster international cooperation to address the great challenges of our time and plays an important role in shaping global political, economic and social developments. [weforum]

On July 15, 2019, Facebook announced that the currency would not be launched until all regulatory concerns had been addressed and Libra had the necessary approvals. On September 18, 2019, during a meeting with leading Senate Democrats, Mark Zuckerberg stated that Libra would not be introduced anywhere in the world without prior approval from U.S. regulators.

A revolution truly looks different. The World Economic Forum member’s message to policy makers and central bankers worldwide that it is time to practically implement the extensive knowledge and experience gained from the crypto ecosystem over the last 10 years into the further development of the fiat financial system was quickly taken up.

On the one hand, the Libra initiative met with considerable resistance from governments, central banks and regulatory authorities worldwide. They expressed concerns about the potential impact on monetary policy, financial stability, anti-money laundering and data protection. In response to this opposition and regulatory pressure, the project was formally renamed and restructured. Within just 6 months of the project’s announcement, Visa, MasterCard, Stripe, PayPal, eBay and Vodafone withdrew from the initiative. Meta finally abandoned the project in January 2022, citing regulatory hurdles. Regulatory authorities around the world intervened and banned privately issued cryptocurrencies as legal tender. [wikipedia]

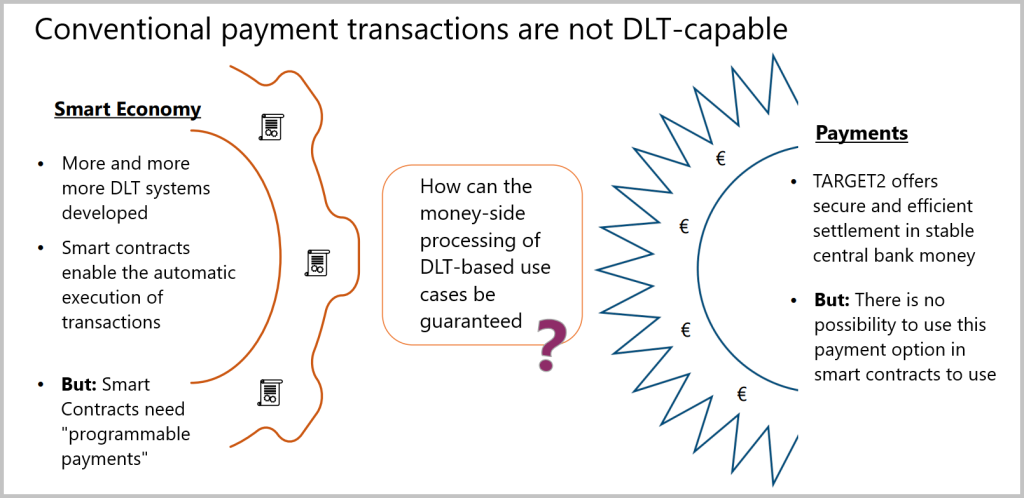

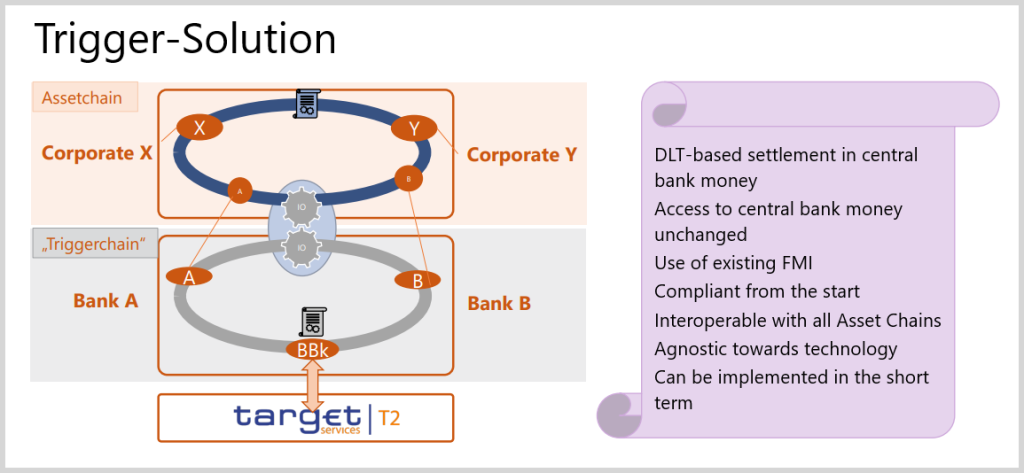

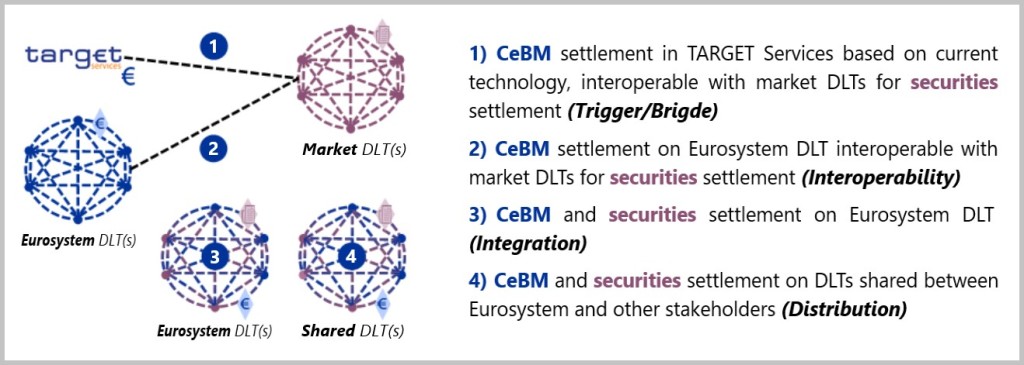

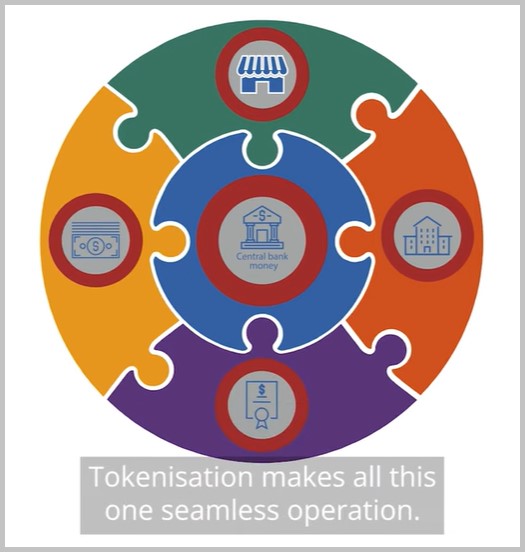

On the other hand, the message led to the recognition that the introduction of central bank digital currencies (CBDCs) is essential for the further development of the fiat financial system. The fact that this is a strategic decision with global implications is highlighted by the Atlantic Council’s involvement in coordinating this process.